How George Soros Flipped Off the Entire British Government and Made a Billion Bucks Aka The Story Of Black Wednesday

- Mark Sarkadi, MBA

- Jun 11

- 3 min read

Updated: Jul 15

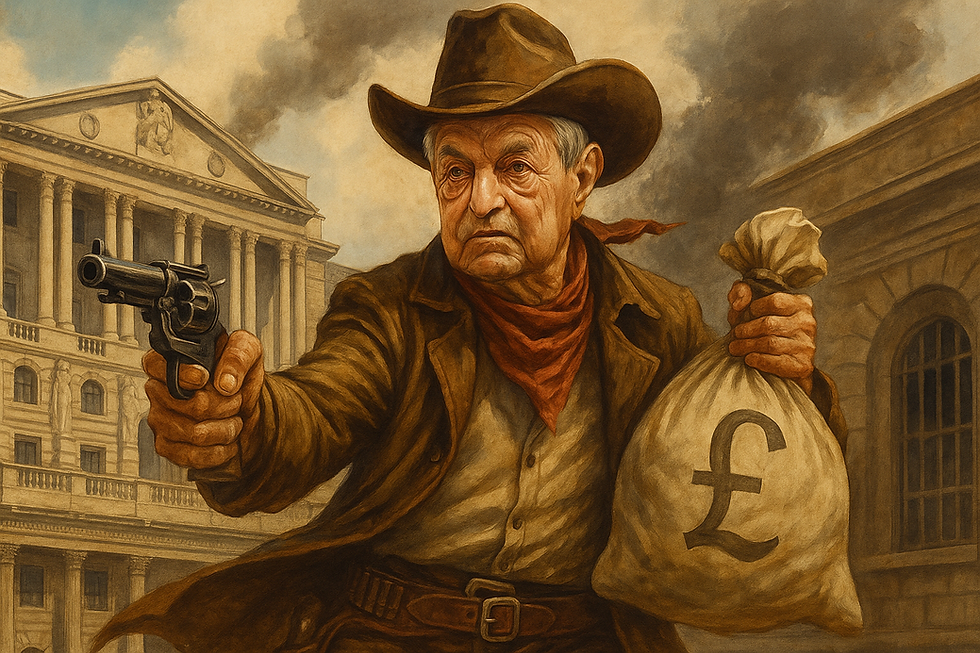

Gather 'round the fire, folks. Today, instead of screamin' about macroeconomic mayhem or market-movin' madness, I got a tale for ya' A tale 'bout a lone cowboy in the wild, dust covered pages of ancient finance history. Not just any drifter, no sir. A shadowy gunman, whispered about in bars and muttered in the back rows of finance lectures as:

The man who broke the Bank of England

It’s the tale of one guy, one currency, and a whole-ass country getting steamrolled by cold-blooded market logic. This ain’t fiction. This ain’t Wall Street fanfic. This is Black Wednesday, and the man behind the chaos was none other than George f*cking Soros.

WTF was Black Wednesday?

You heard about Black Monday. You heard about Black Tuesday. But you know what comes after that? It’s Black Wednesday, my dudes!

Let me paint the scene: it’s 1992, and the British economy is in the toilet. Inflation’s kicking people in the teeth, growth is snoozing like it just popped two Xanax, and the government is pretending everything’s fine like your ex posting gym selfies after a breakup. But they were locked into this European currency straightjacket called the ERM (Exchange Rate Mechanism), which basically meant they had to keep the British pound glued to the Deutsche Mark. Already sounds like a terrible plan Yeah, or maybe and awesome one if you're into financial BDSM.

Now, the pound was clearly overvalued. Like, everybody and their dog knew it. It was the financial equivalent of a cracked-out influencer pretending they're not broke while maxing out credit cards on Gucci slides. Meanwhile, Soros, that sneaky Hungarian sniper with a hedge fund, was watching like a f*cking hawk.

(now all the Hungarian finance bros will appera in my comments like:

🇭🇺🇭🇺🇭🇺🇭🇺🔥🔥🔥🔥🔥🔥 HUNGARY MENTIONED. BOJLER ELADÓ)

This dude went full bloodhound and bet that the UK was gonna snap under pressure and bail on the ERM. So what did he do? He shorted billions worth of pounds, like $10B kind of billions. Now imagine the Bank of England, sweating bullets, doing their best “we got this” dance. They tried buying up pounds like it was Black Friday, jacked interest rates to 10% to 12%, then 15% in one day, you heard that right in ONE F*CKING DAY, hoping someone, anyone, would be dumb enough to hold onto sterling. Spoiler: no one was.

By the end of the day, September 16, 1992 aka black Wednesday, the UK folded like a cheap suit. They pulled out of the ERM, let the pound crash and burn, and Soros walked away with a cool $1 billion. Earning him and his Quantum Fund all the fame and glory. The man didn’t just break the Bank of England, he drop-kicked it in the spine and made it say “thank you.”

And the aftermath?

The UK government looked like a clown show. Chancellor Norman Lamont got roasted, and Soros became a legend. A villain to some, a f*cking god to traders everywhere. The pound crashing actually helped the UK economy recover, proving sometimes you gotta get wrecked before you rise.

The moral of the story: markets don’t give a sh*t about pride, politics, or polite British tea parties, just because the government wants something thing in a healthy capitalist market it can't will it into existence. The market is the only place where you can bet against the house and actually walk away with your winning. And ride into the sunset like George Soros.

Comments