WTF Actually Happened In 1929 AKA The Great Depression

- Mark Sarkadi, MBA

- Aug 14

- 9 min read

Even if you only showed up to one econ class (probably hungover) and spent half the time texting your boyfriend asking “wait babe what’s inflation again?”, you’ve definitely heard of the Great Depression. And no, I’m not talking about that emotional warzone when Bridget Jones loses Mark Darcy. I’m talking Black Thursday, 1929. The big one. The financial faceplant that turned Wall Street into a morgue and wiped out fortunes faster than your ex deleted your pics after the breakup. But here’s the thing: most people know the headlines stocks crashed, people cried, the world went to sh*t. What they don’t know is what actually led to it, how deep the mess ran, and how the whole damn system collapsed.

So if you want the real story, not the “my history teacher skipped this part to show us Forrest Gump” version, I’ve got you. Full timeline. All the dirty background. And yes, we’re naming names and adding a sh*t tone of memes you can steal. Let’s get into the biggest financial f*ck-up of the 20th century.

The bubble that led to the crash

The 1920s was a wild ride. The economy was booming, and the stock market was no exception. The period between 1924 and 1929 is often referred to as the “Roaring Twenties,” a time of excessive speculation, loose morals, and looser credit. Everyone was partying like tomorrow didn’t exist, spoiler: it didn’t.

But this wasn’t some sustainable golden era. Stock prices were getting jacked up like a gym bro on pre-workout. The Price-to-Earnings (P/E) ratios, aka the “is this company actually making money or are we just simping for hype?” meter, were completely unhinged. A solid P/E might be 10. By 1929, people were throwing money at companies with ratios in the 30s and 40s. Basically, folks were paying Rolls-Royce prices for donkey carts. And of course, they weren’t doing it with their own cash. Nah, they were going full degen with margin trading. Put 10% down, borrow the rest, pray to whatever God or Demon handles dumb financial decisions.

If you don't know how margin actually works here is a quick and simple rundown. Buy $1,000 in stock for just $100, and if it goes up 10%, congrats, you’re a genius you just doubled your money, since you get the 10% of the $1000 by using only your $100. But and thats a Kim Kardashian sized But(t) If the stocks drops even a little let' say 10%, you lose all your money, and if it drops even more than that, you’re getting margin called faster than your ex texts you when she’s drunk. Your broker will sell your sh*t without asking. Boom. Broke. And again if it drops more than 10% let's say 20% you don't just lose your $100 you owe the broker another $100, which you might not even have available, so say goodbye for groceries for the week. By late 1929, margin debt was stacked so high you could’ve climbed it and slapped God. The entire market was basically a game of chicken, and no one wanted to blink. But someone always blinks.

The market’s fragility

Let’s be honest: the system back then was held together with confidence and cocaine (just like me in collage). The market was fragile as hell. Liquidity? That b*tch was missing. If you wanted to move large sums of stock, the price jumped like a scared cat. The infrastructure was garbage. It was a financial Wild West. Even worse, the banks were playing both sides. They didn’t just hold your savings, they YOLO’d them into the market (They still do this BTW, if you think your savings and 401K are sitting in a huge Scrooge McDuck vault you are wrong).

But back then things were even less regulated. There was no FDIC. I know you probably heard about the FDIC for the first time and are asking WTF is this mosaic word bulls*t and why does it matter. So, let me explain what are they. The Federal Deposit Insurance Corporation (FDIC) is a U.S. government agency that protects your money in the bank, if your bank goes under, the FDIC covers your deposits up to $250,000 per account. Basically, it’s there to make sure you don’t lose your savings just because your bank played stupid games and won stupid prizes. It was founded in 1933, during the Great Depression, as part of President Franklin D. Roosevelt’s New Deal to restore trust in the U.S. banking system after thousands of banks collapsed and wiped out people’s savings. (But I am jumping a bit ahead so let's get back to our timeline)

So, back in 1929 there were no safety net literally none. No backup plan. Just vibes. So when the market started to slip, banks didn’t just bleed, they bled you. You’d wake up one day and boom, your savings account was now just a fond memory. Add to that the fact that the info lag was insane. No live quotes, no Bloomberg terminals. You got your updates via ticker tape, aka the financial version of smoke signals. By the time you knew what was happening, you were already f*cked. And let’s not forget the best thing I aspire to do: 💅✨ market manipulations ✨💅 these manipulators weren’t Reddit apes; they were actual rich dudes in back rooms doing shady coordinated buys to pump stocks and then dumping them like a Vegas buffet turd. No one was safe, and the system was a joke.

October 1929: the start of the crash

Let's go through a simple timeline

September 1929: peak euphoria. Champagne flowed, jazz played, and people thought the good times would never end.

October 24, 1929: Black Thursday.

that’s when the market took a nosedive like a drunk pigeon. 13 million shares traded hands. Panic hit like a freight train. Brokers were getting flooded with sell orders, and it was pure chaos. The big dogs JP Morgan and his Wall Street crew tried to stabilize things by tossing in some cash and buying blue-chip stocks like they were holy relics. It worked for like... 10 minutes.

October 28: Then came Black Monday. The Dow dropped 13% in a single day. Your portfolio, was basically a bonfire.

October 29: Then Black Tuesday hit. Another 12% drop. That’s like watching your house burn down and then getting hit by a meteor. Over $30 billion in value vanished, in today’s money, that’s half a trillion dollars, gone (like my paycheck when Lego releases new Star Wars sets.) Margin calls flooded in. People were being forced to sell stocks to cover their debts, which pushed prices even lower, which triggered more margin calls. It was a death spiral, a blender of bad decisions, leveraged greed, and way too much confidence.

The banking crisis

This is where things go from “bad trip” to “apocalyptic sh*tshow.” The banks weren’t just watching from the sidelines. They were neck-deep in the swamp, and when the market crashed, they got wrecked. Because (as mentioned before) they’d invested your savings in stocks, when the crash happened, they couldn’t give you your money back. Cue the bank runs. People lined up down the block, trying to withdraw cash that simply didn’t exist anymore. Banks folded like lawn chairs.

By 1933, more than 9,000 banks had collapsed. People lost everything. Small businesses evaporated. Farmers couldn’t get loans. Working families got obliterated. This wasn’t just a “rich people lost their stock money” problem, this was a full-blown economic massacre.

AKA

Welcome to the Great Depression.

Population: everybody.

The Federal Reserve’s (FEDs) mistakes

The Fed f*cked it up harder than my frat bro ass on prom night. In 1928, they finally got around to raising interest rates to cool down the market, a little late, but okay, A for effort. But when the crash came? Instead of slashing rates or flooding the system with liquidity, they did the exact opposite, they tightened credit. It was the economic equivalent of pouring gasoline on a bonfire and then peeing in the other direction. you see this made it harder for businesses to borrow, harder for banks to stay alive, and harder for literally anyone to do anything. IT KILLED LIQUIDITY ONCE AND FOR ALL. It deepened the depression and turned a bad situation into a f*cking tragedy.

The Smoot-Hawley tariff act

Just when you thought it couldn’t get dumber, along came Smoot-Hawley in 1930. The idea was to protect American jobs by slapping big-ass tariffs on imported goods. The result were a total backfire. Every other country said, “oh, word?” and retaliated with their own tariffs. World trade didn’t just slow down, it crashed and burned like a poorly-built crypto exchange. (Weird am I the only one who is having a serious Déjà vu right now? 😂)

Instead of saving jobs, it helped tank the global economy, wrecked U.S. exports, and shoved everyone even deeper into the depression abyss. Oh, and remember Europe? Especially Germany? Yeah, that economic chaos helped open the door for fascists like Hitler to gain traction. So yeah, bad economics helped lead to literal World War. (And you can call me a tin foil hat guy for stating this but that's why I keep screaming about that folks should know and understand basic finance and economics.)

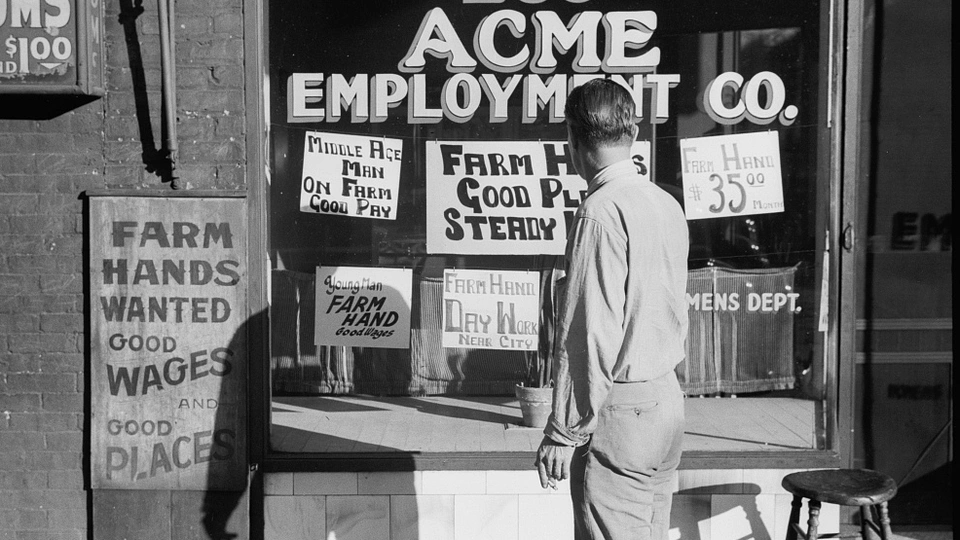

How did we survive this whole sh*t show FDRs New Deal and JM Keynes

The crash didn’t magically sort itself out. The U.S. didn’t just cry into a bottle of gin for a few months and bounce back. The Great Depression dragged on for a full decade, with unemployment stuck at double digits, banks failing left and right, and people doing everything from selling apples on street corners to literally jumping out of windows. It was an economic hellscape, and no one had a clue how to fix it. Herbert Hoover, who had the misfortune of being president when the crash hit, handled it like a guy trying to put out a forest fire with a water pistol. His approach was basically “the market will fix itself” which it absolutely did not. Hoover refused large-scale government intervention and instead gave us a bunch of weak-ass programs and public speeches full of empty optimism while the country was burning. People were starving, banks were collapsing, and he was out here saying stuff like “prosperity is just around the corner.” Bro, the only thing around the corner was another breadline. By the end of his term, the guy's name was literally being used as an insult, “Hoovervilles” were the shantytowns people built after losing their homes.

But than came the man, the myth, the legend, the one true hero entered the ring: John Maynard Keynes came strutting in like a British economist with a god complex (which, to be fair, he kind of was).

Keynes basically flipped the script. While the old-school economists were preaching “tighten your belt and ride it out, the economy will fix itself in the long run" he came out and said his famous words:

"In the long run, we are all dead"

Which basically meant “Screw traditional approach we f*cked up, we have to spend our way out of this mess.” He argued that in times of crisis, governments should inject money into the economy, create jobs, and run deficits to keep the machine from grinding to a halt. This laid the intellectual foundation for FDR’s (Franklin D. Roosevelt) New Deal, a big, bold plan that built roads, dams, bridges, and yes, the FDIC in 1933 that we have talked about earlier.

But it wasn’t just reforms and alphabet soup agencies. The thing that really kicked the economy out of its coma was World War II. The government went full beast mode on spending, building tanks, planes, and enough ammo to flatten half of Europe. Millions of jobs were created, factories roared back to life, and suddenly, America remembered how to make sh*t again. War is hell, sure, but for the economy, it was like shooting adrenaline into a corpse. Meanwhile, Wall Street had to clean up its act too. The Securities and Exchange Commission (SEC) was created in 1934 to slap the hands of shady traders, and over time, new rules were added to stop the market from going full kamikaze again. One of those was the invention of circuit breakers, automatic halts to trading when prices drop too fast, too hard. It’s basically like a “chill the f*ck out” button for the market. If something starts crashing, the system hits pause so panic doesn’t snowball into another 1929-style apocalypse.

And not gonna lie, maybe I should put on my tinfoil hat, but writing all this out made me realize just how insanely fcked the global economy and job market are right now. Like we’re not just heading toward another crash, it’s giving prequel-to-WWIII vibes. More war, more world. And maybe instead of locking in so damn hard all the time, grinding, saving, hoarding like goblins, maybe we should actually do some s*ht. Live a little. Feel something. Because let’s be real, it’d be pretty damn tragic if you spent your whole 20s grinding in silence like a good little boy, finally got your bag at 27, and boom, you get drafted to defend some half-collapsed bridge in Guangzhou for two months, sitting in a trench full of piss and mud until the People’s Liberation Air Force turns you into mist.

But hey, if you do make it back, you’re coming home to a job market where the economy's so cooked that someone with 8th grade education becomes a neurosurgeon, a libral arts degree gets you into investment banking, and you’ll have 32 widowed 20-year-olds in a 1-kilometer radius. So yeah... it might have it's ups and downs. But again I am off topic.

So no 1929 wasn’t just a bad week on the stock market. It was a system-wide failure fueled by greed, margin gambling, clueless regulation, and pure human stupidity. And out of that flaming wreckage came most of the financial safety nets we rely on today. FDIC, circuit breakers, central banks acting like actual adults (or at least they are supposed to be) all of that was built on the bones of 1929. Sometimes it takes burning the whole house down before anyone agrees to install a f*cking smoke detector.