The Flash Crash of 2010: The Fastest $1 Trillion Vanish Act in Market History

- Mark Sarkadi, MBA

- Jul 2

- 6 min read

Updated: Jul 3

Are you ready kids?

(here's the part where you scream:)

AYE, AYE CAPTAIN!

Today I bought you another cool story for recent finance history

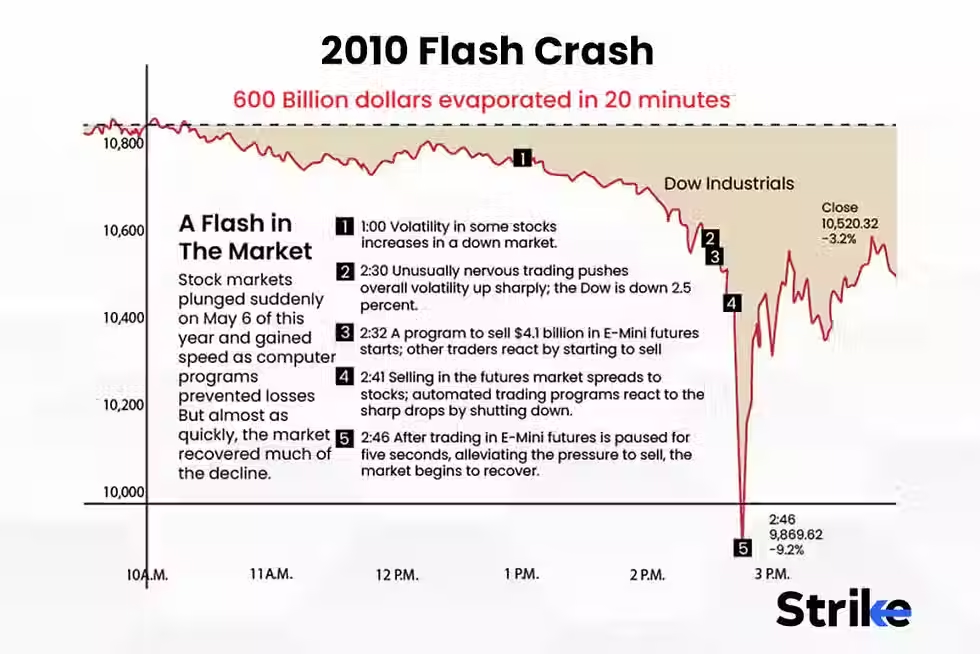

May 6, 2010, started out like any other day on Wall Street. Markets were jittery, Europe was mid-freakout over Greece, the eurozone was on the ropes, and everyone had this uneasy feeling that something stupid was about to happen. But no one expected the market to full-on collapse in real time, in front of millions of eyeballs, like a drunk dude falling face-first into a wedding cake.

At exactly 2:32 p.m. Eastern Time, the Dow Jones Industrial Average, that sacred cow of American finance, started tanking. Not a gentle dip. Not a “hmm, maybe we’re overvalued” kind of slide. We’re talking about a freefall from a cliff. The index lost nearly 1,000 points (9%) in under ten minutes, wiping out around a trillion dollars of market value faster than my ex wiped our joint credit card after the breakup.

The Waddell & Reed fund

So what the hell happened? Here's the part where it gets dumb, and I mean really dumb. This whole thing was kicked off by a mutual fund in Kansas. Not some hedge fund with a villain monologue, not a Russian hacker, not even a fat-fingered intern. Just a good ol’ Midwestern fund called Waddell & Reed. These guys decided to hedge a big position by dumping around $4.1 billion worth of S&P 500 e-mini futures contracts. That’s fine in theory, hedging is quite a normal practice, specially for hedge funds. But these guys decided to use an algorithm that didn’t give two sh*ts about timing, price impact, or market conditions. The algo was designed to sell contracts based on total trading volume. If you been in the markets and finance you are already face palming, if not let me explain what that means.

It basically saying: “just sell 9% of the volume out there until we’re done” but it didn’t have a built-in limiter or pause button. No human supervision. No “wait and see.” It just saw volume, thought “game on,” and started throwing contracts at the wall like a toddler on Adderall. Now here’s where it turns into a fever dream.

HTFs, AKA the oil to the fire during the Flash Crash

Now you are probably wondering WTF is an HTF, is this the new drug the kids are popping at Tomorrowland? HFT stands for High-Frequency Trading. It’s what happens when algos on crack trade stocks, futures, or other securities in fractions of a second, way faster than any human could even blink. These trading firms build ultra-fast bots that plug directly into the exchange. They make money by executing thousands of trades per second, scalping tiny profits off each one. We’re talking like 0.0001 dollars a trade, but do it a million times a day, and boom, you’re rolling in it. Their whole edge comes from speed. Not strategy. Not brains. Just raw, steroidal speed. Some of them even pay to physically place their servers closer to the exchange (literally meters closer) so they can shave off microseconds of delay.

They aren’t trying to hold stocks for hours or even minutes. These bastards are in and out faster than a one-pump chump. Buy now, sell milliseconds later. Rinse. Repeat. That’s the game. Now are they evil? Not exactly. But during crashes or weird market moments, they tend to back the f*ck off, and when they do, liquidity disappears like my paycheck on a in goth girls.

They were a huge culprit in the 2010 Flash Crash. The algos panicked, said “we’re out,” and boom. Liquidity vanished. Buyers disappeared. Sellers had no one to sell to. And in that vacuum, the entire market collapsed into itself like a dying star.

Effects of the crash

Prices tanked with no floor underneath them. That’s when we saw the real circus acts. Stocks didn’t just drop, they evaporated. Some of the biggest companies in the world started trading like pink sheet penny stocks.

Some examples:

Apple (AAPL) fell from $250 to $199.

Procter & Gamble (PG) fell over 30%, then bounced.

But the most famous example is: Accenture, a multibillion-dollar consulting firm, traded for $0.01. Not a visual glitch. Not a typo. Someone literally bought shares of Accenture for one goddamn cent. That means in the middle of the biggest U.S. stock indices melting down, one poor automated sell order hit a standing buy order for a penny and executed. It was legal. It was real. It was the f*cking Wild West.

ETFs were also all over the place, some dropping 50%, some rocketing up like someone had replaced their holdings with magic beans. It was chaos.

Some examples:

iShares Russell 1000 Value ETF (IWD): a massive blue-chip ETF holding solid, boring companies, dropped by over 60% at one point during the flash.

ProShares Ultra Silver ETF (AGQ): this was one of the ETFs that shot up ridiculously, trading at absurdly inflated prices, totally disconnected from its actual net asset value.

SPDR S&P Retail ETF (XRT): this thing tanked during the crash, hitting rock-bottom levels before bouncing back just minutes later.

PowerShares QQQ (QQQ): even big-name ETFs like this one weren’t safe. QQQ took a dive but recovered quick. Still, it showed that not even the most liquid, widely traded names were protected when the bots lost their minds.

As I said it was a total, unfiltered, algorithm-fueled chaos. Some stocks dropped to literal pennies. Others spiked to tens of thousands of dollars for no reason at all. Retail traders watched in horror as their portfolios exploded and imploded on-screen. Some stop-loss orders triggered, dumping their shares at rock-bottom prices. Others got filled at astronomically high prices. In those few minutes, logic went on vacation.

But why is it called the Flash Crash?

Heres the Tbest part. Twenty minutes later, it was all over. The Dow rebounded, almost like nothing had happened. Most stocks recovered, although not all trades were reversed. Regulators were scrambling to figure out what the f*ck just went down. No terrorist attack. No news event. No earthquake. Just a poorly-designed algo, a bunch of HFTs chasing their own tails, and a market structure so fragile it couldn’t survive five minutes of stupid. Imagine watching this real time, your good old retirement portfolio loses 20% and hits all you Stop Losses (SLs) and as soon as you open your brokerage account to assess the damage you see everything bouncing back right where it was without you. You just lost everything and can't even by back at the dip.

The aftermath

In the aftermath, the SEC (Securities and Exchanges Commisssion) and the CFTC (Commodity Futures Trading Commission) basically they should be the sheriffs of Wall Street. They regulate trading, stocks, hedge funds, futures, options, and derivatives markets. They dropped a joint report that said, “Sorry fellas, our bad.”

They blamed the flash crash on the toxic cocktail of algorithmic selling, high-frequency trading feedback loops, and a total lack of safeguards in place to prevent this kind of sh*tshow. That led to the creation of limit-up/limit-down mechanisms, (LULD) single-stock circuit breakers, and other protective rules meant to prevent a repeat performance. These are basically price guardrails for individual stocks and ETFs. If something tries to trade way outside a normal range, it gets frozen instead of executing at some dumbass level like one cent or $100,000. They also added single-stock circuit breakers to pause trading in a name if it moves too fast in too short a time. The idea was to slow the market down just enough for liquidity to come back before things spiral into glitch-city again. They also started pushing for more transparency around algorithmic trading, better data on who’s doing what and when, and more responsibility on market makers to stick around during volatility instead of just ghosting when sh*t gets weird.

In plain English: the regulators basically admitted they had no f*cking clue how fragile and chaotic the market had become, so they tried to plug the leaks with a mix of tech rules, timeouts, and “please don’t bail when we need you” policies. It wasn’t a total fix, but it was the start of regulators realizing that algos and speed were running the show, and the humans were just along for the ride.

I don't know how close you follow the markets these day but spoiler alert:

Markets are still f*cked

and we’re still probably one bug away from another crash, but now we have some duct tape on the system at least.

So what did we learn? Honestly, not much. Markets today are still run by bots, and liquidity still disappears faster than my singles when a stripper looks me with those bedroom eyes. But the 2010 Flash Crash gave us a crystal-clear look at just how brittle and idiotic the whole structure can be. One badly built algorithm, literally just a line of code written by someone in a cubicle in Kansas, managed to break the largest, most advanced financial market in the world. And it did it in under 10 minutes.

If the markets haven't scared you enough good luck sleeping after this. But I leave you with this: When it comes to the markets (or maybe even life itslef) the mentality that you need is Go big or go home. But if you decided to stay risk your home as well so you will have nothing to go home to, that way I guarantee you won't lose.

(I think this is the part where for legal reasons I should state AGAIN that this is not financial advice. I don't want to get letters from the SEC that some of you f*ckers lost your home shorting SPY)

Comments