MOOOOM! Phineas and Ferb Are Messing With Macroeconomic Indicators!

- Mark Sarkadi, MBA

- May 22

- 9 min read

Updated: Jul 15

If you’re throwing money at stocks, crypto, or just trying to buy bread without understanding macroeconomics and macroeconomic indicators, you’re basically blindfolded, drunk, and walking into traffic. It runs the entire game—whether you get to flex in a new Tesla or you're stuck driving some 20-year-old clunker with a busted AC. It decides if you can take your girl out for a proper steak dinner or if you’re splitting a Happy Meal. It’s the difference between buying a house with your wifeor moving back in with your parents. Hell, it even decides how much you’ll pay for your morning coffee and bagel—or if you can even afford one.

So, what the hell is the macroeconomy? It’s the big-ass machine that runs the world’s money game. Unlike your buddy’s NFT collection, this sh*t actually matters. Macroeconomics looks at the huge forces that make or break economies, affecting everything from the price of your groceries to whether your favorite meme stock gets obliterated. The market doesn’t move on vibes, it moves on data. Every big price swing whether it's stocks, crypto, commodities, or forex—has some macroeconomic force lurking in the background. And all these random-ass numbers and charts flashing on your screen? Yeah, they actually control your life. But if you’ve ever tried listening to some finance news or opened the Wall Street Journal, you’ve probably been hit with a bunch of jargon—CPI, PPI, Consensus, FOMC, GDP—and felt like a human trying to communicate with a robot in some sci-fi movie. So, like any sane person, you probably said, “F*ck this,” switched the channel, and threw on Phineas and Ferb instead.

No shame in that—absolute banger of a show. But since you’re here, I’m gonna break down all these fancy economic terms in a way that actually makes sense. That way, next time you watch Phineas and Ferb, you’ll do it fully aware of how the economy is absolutely raw dogging your finances.

The big-ass list of macroeconomic factors & what they mean

Alright, now that we’ve established that macroeconomics is the invisible hand rearranging your wallet and life choices, let’s actually break down the key macroeconomic factors that traders, investors, and even clueless politicians pretend to understand.

I’m grouping them so your brain doesn’t melt, and I’ll keep it short and brutal (like my last relationship)—no fluff, just what it is and why it matters.

1. Inflation: the silent killer of your money

Inflation is that sneaky little bugger that makes your morning coffee more expensive every year while your paycheck stays the same. Now just like with an angry girlfriend nothing can make her happy. Too much inflation? The economy overheats, and s*ht goes south. Too little? Businesses stop making money, and we slip into recession. Now here comes the letter flood, but don’t freak out—I promise it will make sense. Inflation is measured by indexes, and these are the ones that actually matter:

CPI (Consumer Price Index): Tracks the price changes of everyday stuff you buy (food, gas, rent, coffee, Netflix). If CPI is high, your money buys you less, and suddenly, that $5 coffee feels like a crime scene.

Core CPI: Same as CPI, but without food and energy, because apparently, they’re too "volatile." Translation: The government doesn’t want to admit how bad inflation actually is, so they fudge the number a bit by leaving out non-essential things like food.

PPI (Producer Price Index): Measures price changes before they hit consumers. The cost increase of producers, but the thing is noone likes to pay more so, producers, shove tdown the rising cost on your throath. If this is rising, expect businesses to jack up prices soon.

2. Employment: Do people Have jobs or nah?

If people are working, they’re spending. If they’re not, well… the economy starts looking like a zombie apocalypse.

Jobless Claims: How many people just lost their jobs and filed for unemployment. If this shoots up, businesses are f*cked.

Nonfarm Payrolls (NFP): The Super Bowl of employment data. This report shows how many jobs were added or lost last month—excluding farmers, government workers, and a few other not so common sectors (hence, “nonfarm”). A strong NFP means the economy is cooking, but too much job growth can also spook the Fed into raising rates. So once again no matter what NFP is you won't get to fully relax and enjoy Phineas and Ferb.

Unemployment Rate: The percentage of people looking for work or working. This is nor rocket science: lower is good, since then many people have jobs and can pay rent and buy food. But too low means wage inflation, Paychecks get fatter but so do prices and the Fed doesn’t like that. TL;DR: Workers get paid more → Spend more → Prices go up → Inflation stays high → Fed gets aggressive → Markets react (usually badly)

3. Economic growth: ere we expanding or contracting?

The economy is either growing (expending) and making people rich, or it’s shrinking (contracting) and making people cry. When the economy is expanding, businesses make more money, people get hired, wages go up, and stocks tend to rise because investors see growth. When the economy contracts, companies cut jobs, spending drops, recessions hit, and the market starts looking like a f*cking funeral. The state of the growth is meassured by the following indexes:

GDP (Gross Domestic Product): You probably read about this in your second grade textbook. The total value of everything a country produces. Think of it like the economy’s quarterly report card.

CEI (Coincident Economic Index): A fancy way of saying “how is the economy doing right now?” Tracks current jobs, income, and sales. So this is how things are going now, no future or past perfromance.

LEI (Leading Economic Index): Now we can move onto the future, This is the crystal ball indicator, predicting where the economy is heading based on stuff like jobless claims and new orders. Many folks try to predict recessions based on this, and some of them successfully do so—like Michael Burry (Christian Bale/Batman from the movie The Big Short), who predicted 20 of the last 2 recessions successfully. So yeah, now you see why this is not an exact science.

4. The housing market: the economy’s mood ring

Housing tells you whether people are feeling rich or poor. If people are buying homes, confidence is high. If not, we’re probably in a recession. They basically look at the number of houses sold and bought

Housing starts & building permits: How many new homes are being built. More = economy is strong. Less = recession warning.

Existing home sales & new home sales: Tracks how many homes are actually getting sold. Falling sales usually means rising mortgage rates or a weak economy.

5. Energy & commodities: the Sh*t That Runs the World

The cost of oil, gas, and raw materials affects everything—from groceries to plane tickets. When energy prices go up, transportation, production, and heating costs rise, which means businesses pass those higher costs onto you, the consumer—making everything more expensive. If energy prices drop, inflation cools down, people spend more, and the economy (and markets) breathe a little easier. That's why every traded is focused on oil and energy reports

EIA Crude Oil Inventory Report: Shows how much oil we’ve got in storage. Low supply → Oil prices spike → inflation rises

Natural Gas Storage Report: Same as oil but for natural gas, which affects heating and electricity costs.

6. Interest Rates: the market’s On/Off switch

This is the big one. Central banks control interest rates, and those rates decide whether markets boom or crash. If they hike rates, borrowing gets expensive, businesses slow down, and risk assets (stocks, crypto, real estate) take a hit. If they cut rates, money gets cheaper, companies expand, and markets pump like crazy. Interest rates ar the biggest influence on your life so if you want to learn more, check out this article where we break it down real and simple so even Candace could understand it (get it we are still at the Phineas and Ferb references) Interest is decided at:

FOMC meeting & rate decision: This is when the Federal Reserve decides whether to raise, cut, or hold interest rates. Higher rates? Markets dump. Lower rates? Markets pump.

Fed Minutes: The receipts from the last Fed meeting. Traders dig through these looking for clues about future rate moves.

7. Trade & global factors

Economies don’t exist in a vacuum it's not your eceonomics textbook —global trade, supply chains, and currency movements shake up everything. If a country is exporting more than it's importing, money flows in, boosting its economy. If it’s the other way around, money leaks out, weakening its financial position. That’s why trade data is a big deal—it shows whether a country is a winner or a loser in the global money game.

Trade balance: The difference between exports and imports. A trade deficit can weaken a country’s currency.

Import & export prices: Tracks how much the cost of trade is changing. If import prices spike, businesses pass the pain onto you.

Okay, this might have been a lot, but I’ve got two pieces of good news for you.

One: Now you actually know all that is to know and follow about macroeconomics, and you can always come back here and reread stuff whenever the economy starts acting like a drunk driver.

Two: You don’t have to track every single indicator like some over-caffeinated Wall Street analyst. If all you care about is whether you can finally move in with your girl or if it’s time to start unpacking your boxes in your mom’s basement, just focus on the big ones.

The top 3 most important macroeconomic factors

Alright, let’s strip it down to the only three things that actually matter when you’re trying to figure out where the market is going. If you track these, you’ll be ahead of 90% of traders and 99% of regular folk who get wrecked chasing hype and guessing price moves.

1. Inflation (CPI & Core CPI)

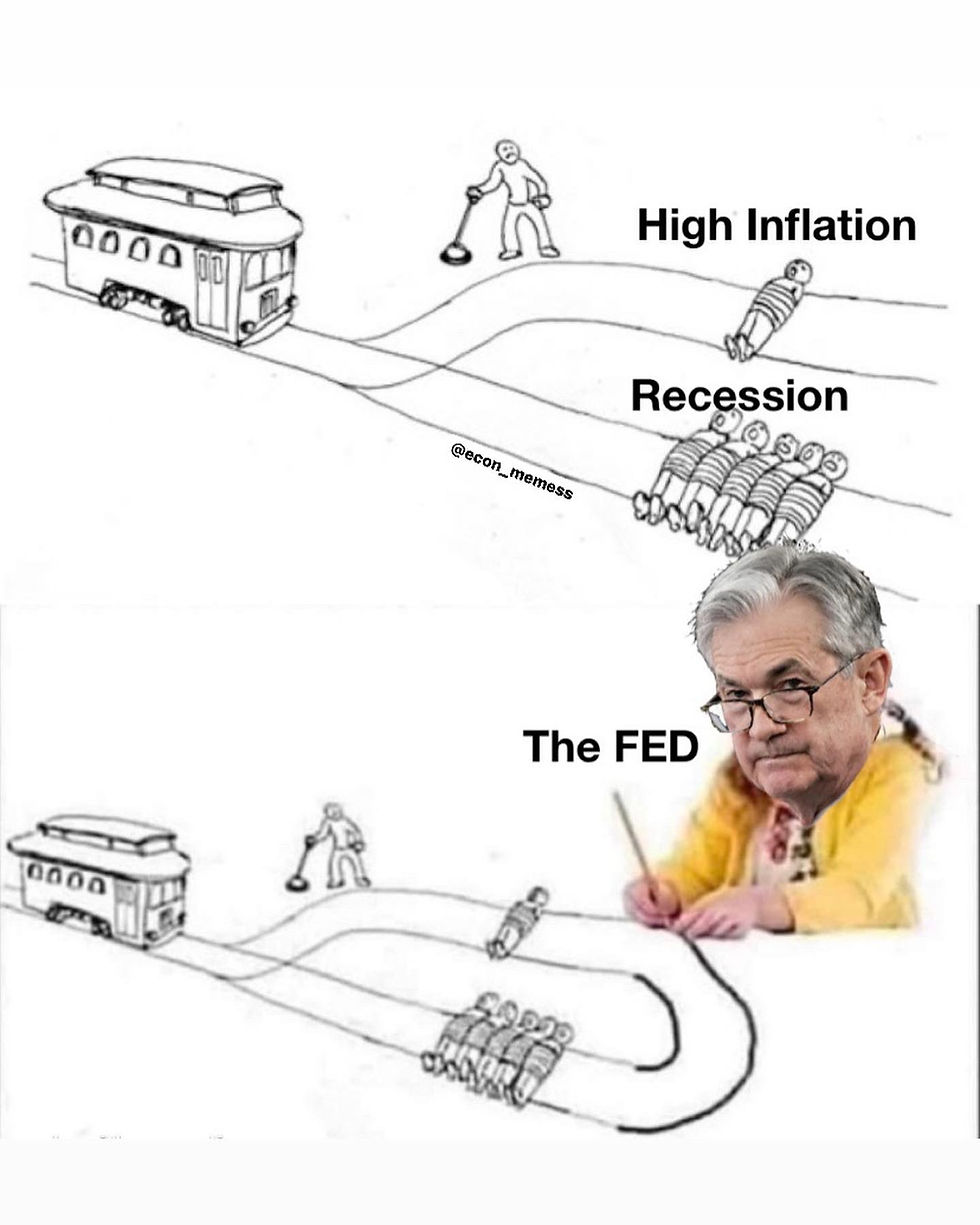

Inflation is the most important factor because it decides what the Federal Reserve does—and when the Fed moves, the entire market follows. If inflation is too high, the Fed raises interest rates, which makes borrowing expensive, slows down businesses, and causes stocks and crypto to tank. If inflation cools down, the Fed stops hiking or even cuts rates, making money easier to get and sending markets flying.

If CPI comes in higher than expected, the market freaks out because it means inflation is still a problem, and the Fed will likely keep interest rates high. If CPI drops lower than expected, traders get excited, expecting the Fed to ease up, and risky assets like stocks and crypto start pumping. If you only check one macro report every month, make it CPI.

2. Interest rates (FOMC meetings & rate decisions)

The Federal Reserve controls interest rates, and their decisions decide whether markets boom or crash. When the Fed raises rates, borrowing becomes expensive, companies slow down, and risky investments take a hit. When they cut rates, money gets cheaper, businesses expand, and markets go crazy.

Every time the Fed meets, traders wait to see whether they’ll raise, cut, or hold rates. If they raise rates, stocks usually drop, the dollar gets stronger, and borrowing becomes a pain in the ass. If they hint at rate cuts coming soon, the market treats it like free money, and stocks and crypto start surging. The Fed’s decisions shape everything, so tracking their meetings and rate announcements is key.

3. Jobs data (Nonfarm payrolls & jobless claims)

The job market is the Fed’s favorite excuse for deciding whether to raise or cut rates. If the economy is adding too many jobs, people have more money to spend, which keeps inflation high. That makes the Fed nervous, and they keep rates high to slow things down. If unemployment starts rising, the Fed starts worrying about a recession and considers cutting rates to keep the economy stable.

The two biggest job reports to watch are Nonfarm Payrolls (NFP), which comes out once a month, and Jobless Claims, which drops every week. If NFP shows a ton of new jobs being created, the Fed might stay aggressive with rate hikes, and stocks could struggle. If jobless claims start rising, it’s a sign that the economy is slowing down, and the Fed might start looking at rate cuts, which is good for markets.

Where to track these macroeconomic indicators

You don’t have to dig through boring government websites to stay on top of this data. Here are some easy places to track macroeconomic reports in real-time:

Forexfactory – https://www.forexfactory.com/calendar (Great for a quick macro calendar)

Trading Economics – https://tradingeconomics.com/ (Full economic data & historical trends)

Investing.com Economic Calendar – https://www.investing.com/economic-calendar/ (Real-time data with market impact ratings)

Federal Reserve FOMC Meetings & Statements – https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm (Official Fed meeting dates & rate decisions)

That’s it. No more guessing, no more blindly following hype—just logic and real data. Now go forth, watch Phineas and Ferb with a newfound understanding of how the economy is f*cking with your life, and trade smart.

Comments